Meridian (MRBK)·Q4 2025 Earnings Summary

Meridian Corporation Delivers Strong Q4 as Earnings Jump 28%, Raises Dividend 12%

January 29, 2026 · by Fintool AI Agent

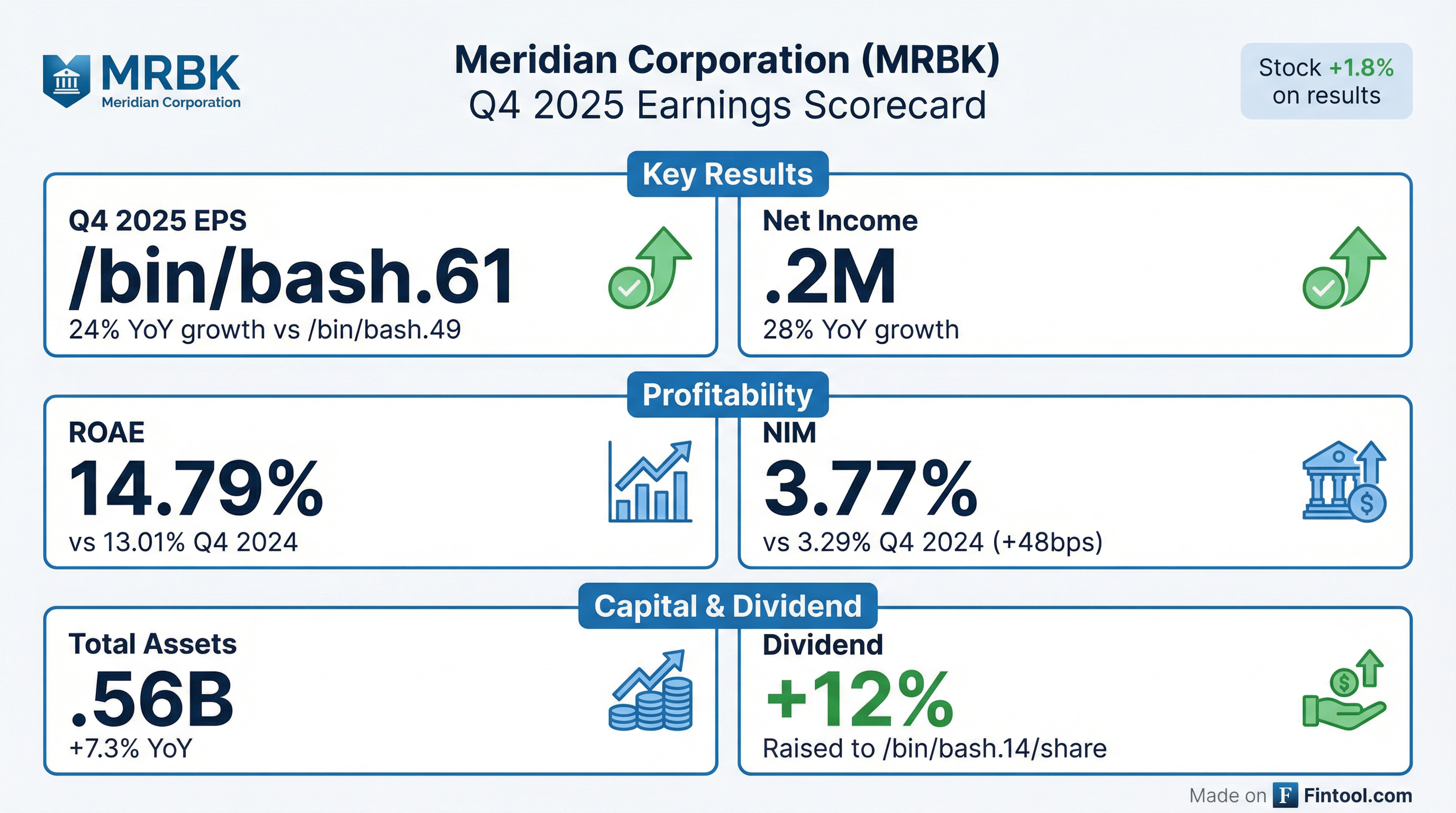

Meridian Corporation (NASDAQ: MRBK) posted another strong quarter, with Q4 2025 net income rising 28% year-over-year to $7.2 million and EPS of $0.61, up from $0.49 a year ago . The Delaware Valley-based community bank benefited from continued net interest margin expansion, disciplined expense management, and double-digit commercial loan growth. The Board rewarded shareholders with a 12% dividend increase to $0.14 per share .

Stock Reaction: Shares are trading up ~1.8% to $18.60 following the release, approaching the 52-week high of $19.24.

Did Meridian Beat Earnings?

Meridian delivered robust year-over-year growth across all key profitability metrics:

For full-year 2025, earnings jumped 33.6% to $21.8 million from $16.3 million in 2024 .

What Drove the Quarter?

Net Interest Margin Expansion

The standout story continues to be margin improvement. NIM reached 3.77% in Q4, up 48 basis points from 3.29% a year ago :

The margin benefit came primarily from declining deposit costs. Time deposit costs fell 14 basis points in Q4, and $473 million in term deposits are set to reprice in the next six months at ~3.70%, down from current blended rates of 3.77-4.03% .

Commercial Loan Growth

Meridian's core commercial lending franchise delivered 10.7% year-over-year growth :

Total loans reached $2.17 billion, with the commercial portfolio (83% of loans) driving growth .

How Did the Stock React?

Shares are trading up approximately 1.8% following the release, approaching 52-week highs. The stock has gained 12% over the past year:

What Did Management Say?

CEO Christopher Annas struck an optimistic tone, highlighting Meridian's 22nd consecutive year of organic growth :

"Annual earnings grew 33.6% over 2024 to $21.8 million. Year-over-year growth of our core commercial, industrial, and real estate loan portfolios equaled 10.7%, driven mostly through new and existing loan relationships."

On the competitive environment:

"A series of acquisitions in our market during 2025 has positioned us to take advantage of customer and employee turmoil. Through our brand and strategic marketing efforts we expect to leverage this strength to our benefit in 2026."

On margin dynamics:

"We have benefited from lower core deposit rates to our commercial business because of pricing elasticity, but also from excellent management of our brokered deposit stack."

What Changed From Last Quarter?

Sequential Performance (Q4 vs Q3 2025)

The increase in non-interest income was driven by a $405K gain on investment securities sales, improved fair value changes, and higher wealth management income .

Segment Performance

Meridian operates three segments. The core Bank segment delivered pre-tax income of $8.5 million in Q4, up 83% YoY :

Wealth Management: AUM grew 7.8% YoY. The company hired three new wealth advisors in 2025 .

Mortgage: Segment profit collapsed from $2.4M to $320K YoY, impacted by challenging volume trends and the absence of MSR sale gains that benefited Q4 2024. The segment was streamlined in 2025 to ensure profitability .

Capital & Dividend

The Board declared a quarterly dividend of $0.14 per share, up 12% from $0.125 previously, payable February 17, 2026 to shareholders of record February 9, 2026 .

Tangible book value per share grew 10.2% YoY. The bank raised $7.5 million through an ATM stock offering during the quarter .

Asset Quality — The Watch Item

Non-performing loans remain elevated at 2.50% of total loans, though down slightly from 2.53% in Q3 :

SBA Portfolio Stress: $24.8 million of NPLs are SBA loans, with 54% originated in 2020-2021 before the 500+ bps rate increase . Importantly, $13.2 million (53%) of SBA NPLs are government-guaranteed .

Management noted "slow progress" as recoveries improve and troubled assets migrate toward disposition .

Earnings History — The Trajectory

Meridian has delivered consistent earnings growth, with the Q1 2025 dip reflecting seasonal factors and elevated provisioning:

Full-year 2025 EPS reached $1.89, up 30% from $1.45 in 2024 .

Forward Catalysts

- Continued Deposit Repricing: $473 million in time deposits repricing at lower rates over next 6 months should support margins

- M&A Disruption: Competitor acquisitions creating customer/talent opportunities

- Wealth AUM Growth: 7.8% YoY growth and three new advisors driving fee income

- Florida Expansion: New full-service branch opened in Q4

Key Risks

- Elevated NPLs: 2.50% NPL ratio above industry norms, particularly in SBA portfolio

- CRE Concentration: CRE 300 ratio at 284% of risk-based capital, above regulatory guidance threshold

- Mortgage Headwinds: Segment profitability collapsed 87% YoY; volume dependent on rate environment

- Rate Sensitivity: NIM expansion tied to continued deposit repricing; asset yields declining

The Bottom Line

Meridian delivered another quarter of double-digit earnings growth, driven by margin expansion and commercial loan momentum. The 12% dividend increase signals management confidence, though elevated NPLs and CRE concentration warrant monitoring. With tangible book value up 10% YoY and a clean path to continued deposit repricing, the bank appears well-positioned heading into 2026.

Data as of January 29, 2026. Stock prices and market data subject to change.